mi property tax rates

Homeowners pay an average of 161 of their home value in property taxes or 1611 for every 1000 in home value. Departments O through Z.

2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY.

. For example if a property is a principal residence with a taxable value of 50000 and is located in Humboldt. Send your check money order to. Beginning March 1 2023 all unpaid taxes are considered delinquent and are payable with additional penalties to Oakland County Treasurer.

Property Tax Lansing MI - Official Website. Detroit Taxpayer Service Center Coleman A. Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County.

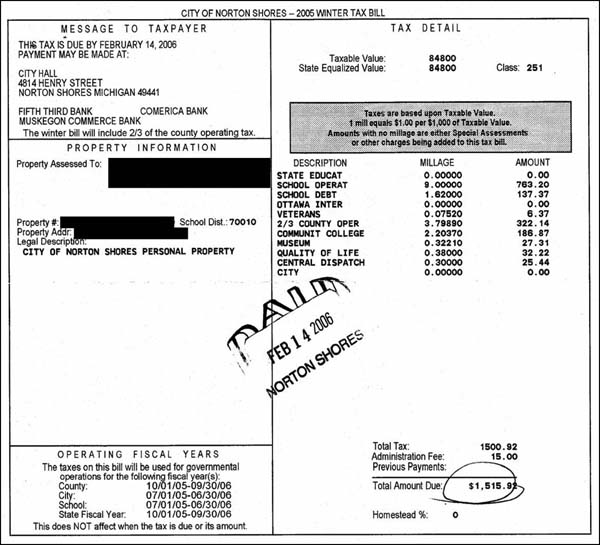

Alger Au Train Twp 021010 AUTRAIN-ONOTA PUBLIC 245800 425800 185800. On February 15 2023 penalty of 3 will be added. Property owners can calculate their tax bill by multiplying their taxable value by the millage rate.

The calculator can provide. CITY OF BIRMINGHAM-TAXES PO. That updated value is then multiplied times a combined levy from all taxing entities together to set tax due.

Property tax information is. 84 rows To find detailed property tax statistics for any county in Michigan click the countys. Simply enter the SEV for future owners or the Taxable Value.

An appraiser from the countys office establishes your propertys market value. Counties in Michigan collect an average of 162 of a propertys assesed fair. The Property Tax Calculator is designed to provide tax estimates by multiplying the property values entered and the most current millage rates available.

BOX 671732 DETROIT MI 48267-1732. You can now access estimates on property taxes by local unit and school district using 2020 millage rates. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment.

Birmingham Homeowners Principal Residence Tax Rates. Treasury Income Tax Office. For example if the citys millage rate is 10 mills property taxes on a home with a taxable value.

In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313. Young Municipal Center 2 Woodward Avenue - Suite 130 Detroit MI 48226 313-224-3560 800 am - 400 pm City of Detroit CFO. 32 rows Multiply the taxable value by the millage rate and divide by 1000.

The average effective property tax rate in Macomb County is 168. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. The Great Lake State is a high-tax state.

2021 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOO 319946 499946 259946 379946 359946 539946. We are open Monday through Friday from 830 am to 430 pm. Bay County Building 515 Center Avenue Suite 602 Bay City Michigan 48708-5122 Voice.

For more details about the property tax.

Top Counties With Lowest Effective Property Tax Rates In 2021 Attom

2020 Michigan County Allocated Tax Rates Center For Local Government Finance Policy

Michigan Tax Rates Rankings Michigan Income Taxes Tax Foundation

Detroit Taxes And The Laffer Curve Marginal Revolution

Property Tax Calculator Smartasset

See The 50 Communities With Michigan S Highest Millage Rates Mlive Com

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Where Do People Pay The Most In Property Taxes

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Compare 2021 Millage Rates In Michigan Plus Fast Facts On Property Tax Trends Mlive Com

Michigan Property Values Citizens Research Council Of Michigan

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics

Michigan Family Law Support January 2019 2019 Federal Income Tax Rates Brackets Etc And 2019 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Taxes Pittsfield Charter Township Mi Official Website